NOTICE OF PROPOSED PROPERTY TAX INCREASE

Benchmark Millage Rate to Stay the Same for 19th Consecutive Year

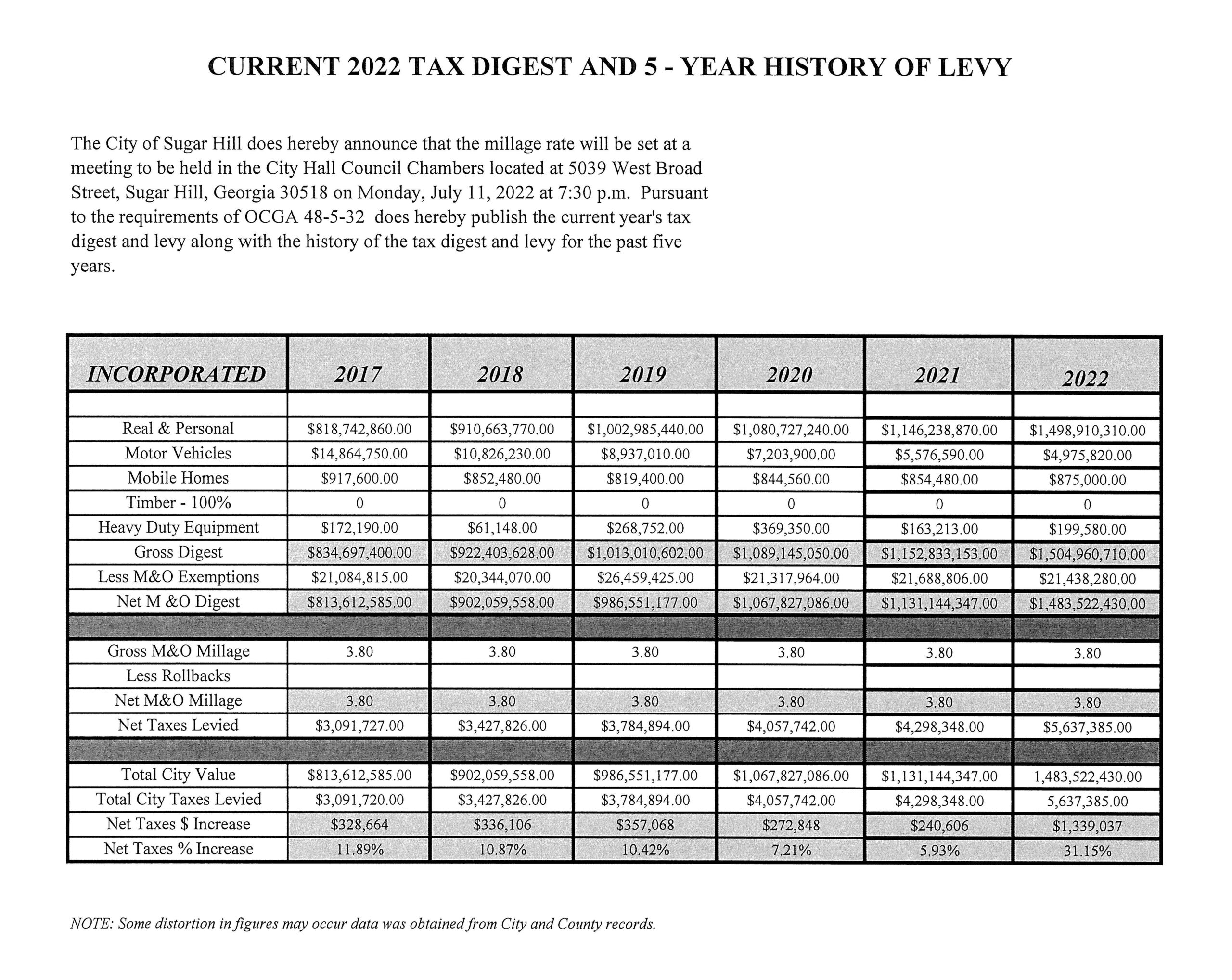

The city of Sugar Hill has tentatively adopted a 2022 millage rate of 3.8 mils, which is the same millage rate the city has adopted for 18 consecutive years. Without this tentative tax increase of 21.68%, the millage rate would be no more than 3.123 mills. The increase results from the reassessment of property values in the city by the Gwinnett County Board of Tax Assessors as well as new construction added to the tax digest over the last year, not an actual increase in the millage rate.

The proposed tax increase, without a rollback, for a homestead property in the city with an average fair market value of $400,000 is approximately $108.00 per year; the proposed tax increase, without a rollback, for non-homestead property in the city with an average fair market value of $525,000 is approximately $142.00 per year.

All concerned citizens are invited to attend the public hearings to be held at City Hall, 5039 West Broad Street, Sugar Hill, Georgia on the following dates and times:

Tuesday, July 5, 2022, at 6:30 p.m.

Monday, July 11, 2022, at 8:30 a.m.

The Mayor and Council will hold their regular monthly meeting on Monday, July 11, 2022, at 7:30 p.m. and will conduct the third Public Hearing before taking final action to set the 2022 millage rate.